Introduction – L&T Finance Ltd क्या करती है?

L&T Finance Ltd Share Analysis

L&T Finance Ltd भारत की एक प्रमुख NBFC (Non-Banking Financial Company) है, जो retail और wholesale दोनों segments में financial products और services offer करती है।

Company ने Systemically Important Non-Deposit Accepting Core Investment Company (NBFC-CIC) के रूप में registration के लिए requisite application file कर दी है, जो इसके long-term structure को और मजबूत बनाती है।

यह blog investors और traders दोनों के लिए useful रहेगा, क्योंकि इसमें fundamental + growth + valuation + risk factors को detail में explain किया गया है।

Business Overview

L&T Finance का main focus रहा है:

Retail Lending

Rural & Farm Finance

Housing Finance

SME & Infrastructure Finance

Company धीरे-धीरे retail-heavy portfolio की तरफ shift कर रही है, जिससे risk diversification बेहतर होता है और earnings stability आती है।

Key Financial Highlights

Parameter. Details

Market Cap ₹79,921 Cr

Current Price ₹319

52W High / Low. ₹329 / ₹129

Stock P/E. 29.6

Book Value ₹105

Dividend Yield 0.86%

ROCE. 8.71%

ROE. 10.8%

Face Value ₹10

➡️ Valuation perspective से देखें तो stock premium pricing पर trade कर रहा है।

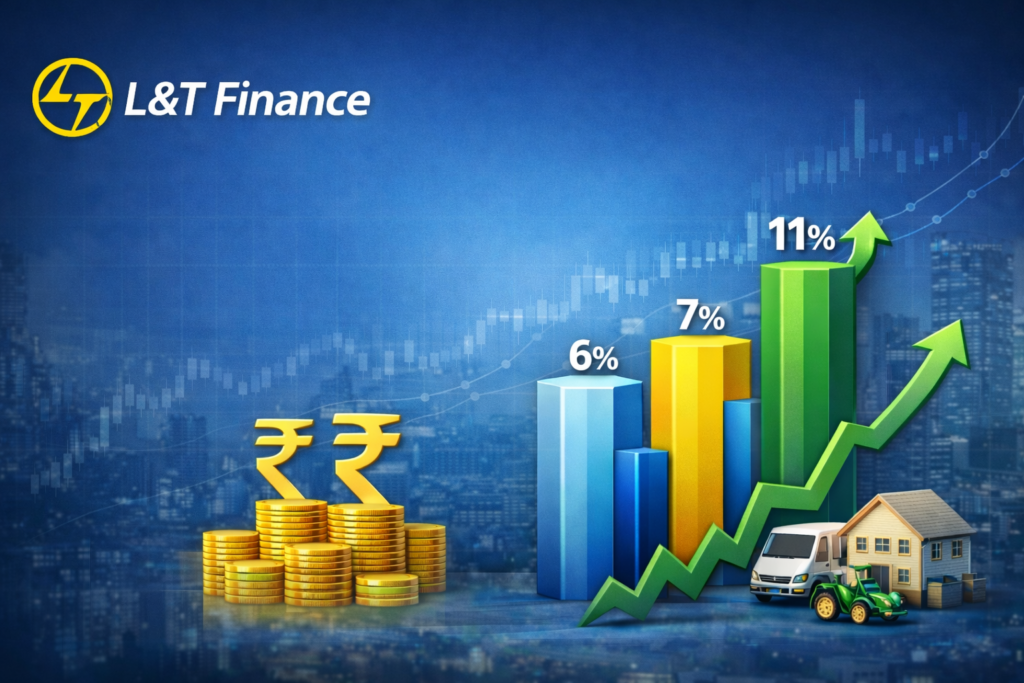

Growth Analysis – Compounded Performance

📈 Compounded Sales Growth

10 Years: 9%

5 Years: 2% (weak phase)

3 Years: 10%

TTM: 11%

👉 Recent years में sales growth recovery साफ दिखाई दे रही है।

📊 Compounded Profit Growth

10 Years: 13%

5 Years: 9%

3 Years: 45% 🔥

TTM: 5%

👉 3-year profit growth बहुत strong रहा है, indicating better operating efficiency.

💹 Stock Price CAGR

10 Years: 18%

5 Years: 27%

3 Years: 54%

1 Year: 129% 🚀

➡️ Price performance ने fundamentals से तेज run दिया है, जो future में consolidation risk बढ़ाता है।

Return Ratios – ROE Trend